PartnerStack is placing bets on what’s to come in B2B SaaS: go-to-market trends, data spends, partnerships and alignment between VCs and startup founders in 2024. Buckle up, it’s going to be a wild year of new tech experimentation (with hopes of wins and expectations of some failures), multiple GTM motions and the end of the software recession.

We sat down with PartnerStack’s executive leadership, CEO, Bryn Jones, and CMO, Tyler Calder, to evaluate predictions buzzing around the B2B market. Whether we’re talking about the return of ARR (annual recurring revenue) or entering a new era of expertise and trust, Jones and Calder are confidently wagering on which trends will thrive and which trends any in-the-know B2B expert would take a pass on.

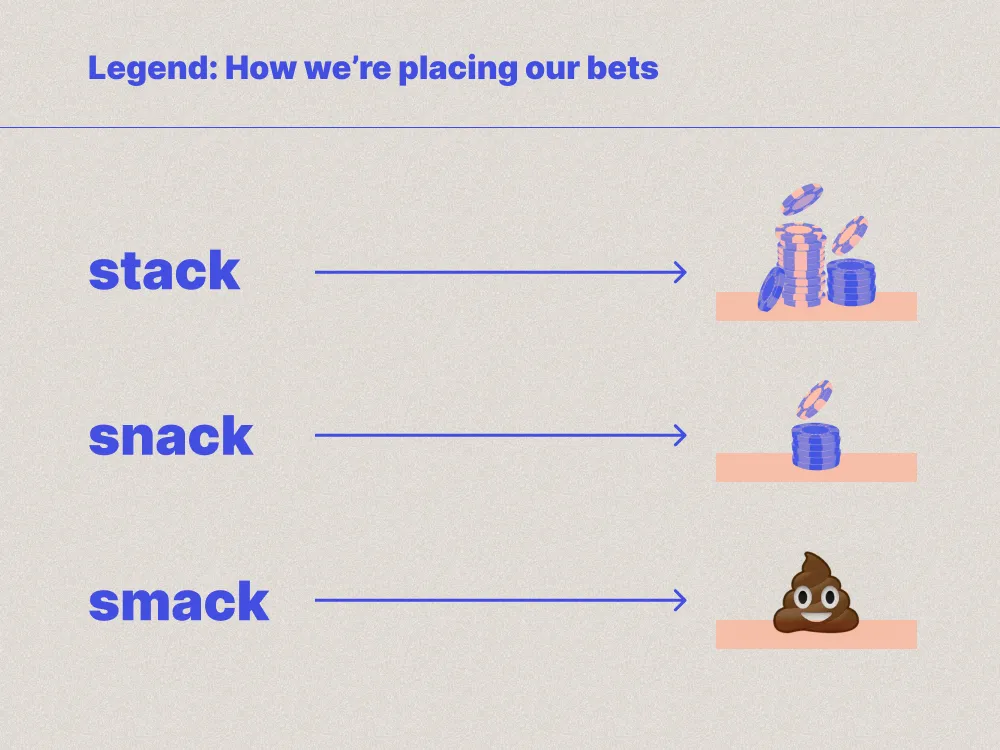

To break down Jones and Calder’s confidence in each prediction, they’ll give them a ‘stack’, ‘snack’ or ‘smack’. We’re doubling down with a ‘stack’, gently betting with a ‘snack’ and will shut down a concept with a ‘smack’.

Some things, we know for sure: B2B marketing, sales, customer success and product teams will continue the journey of customer obsession and partner ecosystems will continue to grow as partner-sourced revenue becomes more relevant across the SaaS industry. Some things we hope will happen (a new era of expertise and trust) — and, of course, there are things we don’t think will come to fruition at all.

Now, let’s dive deeper with our experts and predict our business year ahead in B2B SaaS, partnerships and more.

Editor’s note: Interview quotes have been condensed and edited for clarity.

Snack: Adoption of AI and ML in marketing automation

Calder provides his CMO perspective on the growth of artificial intelligence and machine learning in marketing adoption. While he believes AI itself will not be a product in itself — this CMO is predicting AI and ML will be layered and integrated across the partner ecosystem.

Calder: “So, I don't think AI itself will be a product — not that that's what you're suggesting with this trend — but, I think you see it with every single company, AI will be a feature of every product you come across. It is going to be embedded in some way, shape or form. Companies that fall behind on thinking about how they'll integrate will probably be left behind to some degree. I just call BS on companies that make AI their entire thing. The biggest winners will certainly be the big tech companies that earn on consumption — more so than some fancy new startup that comes along with some big play.

Within the partner ecosystem, I think that's where you start to see people making a ton of cash in supporting the adoption, the implementation, the change management, within the enterprise, when it comes to AI and machine learning. And I know I'm not speaking directly to marketing automation, but I think that's what this looks like — it’s a ton of hype right now, a lot of people making some pretty good money, trying to capitalize on the hype, the big infrastructure companies like the hyperscalers, early non-consumption. And then the rest is just baked into the product. If I'm in HubSpot — help me write an email, help me analyze my data, that type of thing.

Here's the holy grail with all of this stuff. In marketing, well, I think in any role, you're always thinking, where do I spend my next dollar? Just go spend it there. Just do it. And I think, within partnerships, it's kind of the same, like, how to identify the best partner for a given scenario in real time? How do I route a lead in real time to the right reseller? How do I, in real time, change my incentive model for an affiliate based on what I know about every player in that equation? I think that's the holy grail. And I think you'll just see people kind of chipping away at that.”

See more: How to become a T-shaped ecosystem leader.

Stack: Partnerships will drive more acquisitions than ever before

As partnerships continue to evolve and grow in 2024, this GTM motion may find some more sustainability by being viewed as a marketing channel while also helping lead and customer acquisition. Partnerships as a motion may outperform more traditional marketing plays (think: paid search, paid social, organic events, etc.) Through partnerships, sustainable revenue growth becomes scalable and possible this year.

Calder: “This has to be a stack, right? I’d unpack the word acquisition a little bit, because I think that changes my view. When we say acquisition, you could talk about lead acquisition or customer acquisition. Obviously, both related but still different. And, where I'm going with that is: I think the biggest opportunity is companies starting to view partnerships as a marketing channel.

I've kind of been thinking about this as distributed demand generation, where you have some of the best marketers on your team that are 100 per cent commissioned. You're just paying for straight performance — I genuinely believe some of the best performance-based marketers have gone freelance and gone affiliate. Why wouldn't you? You can make an absolute f–king killing. And when you stack up what some of them can deliver against other marketing channels, whether it be paid search, paid social, organic events, they're likely going to outperform across almost every metric.

Once companies start to look at partnerships, beyond tech partnerships, integration, partnerships, reseller partnerships — that's when I think things get interesting because where most companies struggle, and why this may not be a stack is, most companies struggle to scale all of this. They get stuck with maybe four or five really solid reseller partners, but they don't know how to grow from there. They get stuck with 100 affiliates, but they don't know how to turn that into 1,000 or 5,000. That's what marketers have always been good at is like, how do you scale the s–t out of a thing that's working? And I think you got to throw that lens on this. And that's when it becomes a stack.”

Jones: “I believe that partnerships will drive more acquisition than ever before. Will partnerships achieve the unlock that I want it to see? I think that it's an incremental climb up this mountain. When we look back, we'll see just how far we've come relative to other go-to-market motions inside of a B2B company. I believe that partnerships will stack, it will be a big win in 2024. I think there's just so much more opportunity than people realize — and to Tyler's point, in order for partnerships to be in a state where you can stack — you need to have those scalable systems put in place to support that. This isn't just people. We are at a moment in time where we are asked to do more with less, and partnerships is that answer. And, until you're willing to put the infrastructure required behind your partnerships to make that happen, you're gonna keep delivering the same incremental results as you did the year previous. And the best news about that is it's better than the year before. The worst part about it is you're not achieving your potential. So very excited for what's there — I want it to be more than it is and we're here to support anybody that's ready to make that happen.”

Stack: The return of ARR

Following a couple challenging years in tech and startups, we’re calling the end of the software recession. Jones is calling this one a ‘stack’ while Calder’s instincts lead him to ‘snack’ — agreeing that buying may be happening again — but predicting there will be choice pieces of tech those investments will be going into. In 2024, Calder believes more companies will be operating beyond measuring business performance against ARR bookings — and focus more on recognized and collected revenue.

Jones: “Yes, the software recession is over today. In Q1 2024, the software recession is over from a buying side. The software recession actually ended in Q2 2023 and we started to see an acceleration in purchases of software in Q3 2023. At PartnerStack, we can see this in real time, we have visibility into hundreds of millions of dollars of sales that occur on our platform facilitated by partners. And we could see a huge pickup start happening in Q3 — for us and for our customers. We don't know what 2024 is going to look like, but the hardest thing to do is grow. A lot of people thought the hardest thing to do was cut — as challenging that is personally and for teams, it is actually much harder to build something that is growing.

ARR doesn't mean the return of the same go-to-market motions that used to work in 2015 through to 2018. I remember going out and talking to VCs over and over again — and I remember being laughed out of rooms when people were talking about partnerships because they said, ‘Why wouldn't I just put $10M into a direct sales team?’ We all know all of those ‘whys’ now. And so what I know is the return of ARR in 2024 is going to look a lot different. But we are back to growing.”

Smack: Marketing data spending in the US is expected to reach $3.91 billion in 2024

CEO Jones smacks this one down while CMO Calder’s instinct is to stack it. Jones thinks the focus should be more on the results the data spends drive — while Calder, though not suggesting it’s right, believes this is likely how marketers will definitely be spending their dollars.

Jones: “I believe marketing data spend is going to increase, but I'm going to smack this and the reason why is because I don't think it's going to be about the marketing data spend. I think it's going to be about the results that the data spends will drive. This is where I actually expect AI and ML to sit and provide marketers a tremendous benefit. It's going to let marketers do more with less. But I think the way that occurs is — it's actually not about the spend on data — it's about the results that the data is ultimately driving. So, if those results increase in a substantial way, then this market could increase big time.

But what I actually suspect is going to happen is a lot of the findings will amount to useless data. I think the result of that could really drive marketing data spend down. The way that it will be driven down is through automation, AI, ML. Because all of a sudden, we're going to be able to go through data, provide an analysis and get to the point faster — which is going to make things more efficient. So, I could see it going down in the short term, and then increasing in the long term, because I do actually think it needs to go down to reset on what is actually valuable — before dumping more investment into what's there.”

Calder: “I would think that this is a stack — and I'm not suggesting it's right or it's where they [marketers] should be spending the money. But I definitely think it's where they are going to be spending some money. Because I think they are trying to figure out, What the f–k do I do? And, if they can go in, and this becomes not just a marketing investment, but a whole data infrastructure type of investment, they're working with the CTO, they're working with data ops — I could see this becoming like one of those investments that kind of falls under the guise of transformation. I could see it happening.

The data spending that was happening was to open up the market — the targetable market — as much as possible: ‘Give me as many contacts as possible, I just want to drive leads into the funnel. That is what I’m measured on — who cares if it's not sticky revenue. Just get the money and we'll figure it out after the fact’. I think as long as those leads were within these very broad ICP parameters, all was good.

What's changing is, more and more companies are spending on data to shrink their targetable market. They're trying to say, ‘No, it's not what we did in the past, it's not trying to get in front of as many people as possible — it’s trying to get in front of the right people — the right revenue, the revenue that's going to stick.’ The existing tools are not good at that. The existing tools were built to give you as much as possible. And now, I need another investment to help me sift through all of that s–t to figure out who do I actually invest in? So, I think you'll see companies in 2024 have probably two or three different investments into data providers, as they try to figure out what's the right one. We see this in our data. When you look at some of our fastest growing categories in our Network, a lot of them are just data providers to sales and marketing. Again, is it right? Probably not. Why do you need three or four or five data tools? But I think 2024 is going to be a year where a lot of companies continue to invest as they try to figure it out.”

Stack: B2B marketers will double down on content based on original research and data

This trend sees the industry shift from ‘thought leadership’ content towards content grounded in original research and data. With easy access to AI tools, it’s become more efficient for anyone to spin up a content strategy, but Calder and Jones call out the need for data-driven content that offers original insights. They predict going beyond content based on surveys and organizations looking at their own original insights, and that of their partners, to create more meaningful content.

Calder: “I mean, this is all that's left. Anyone can spin up good enough content with ChatGPT, at least for now, until it's completely saturated. What can't it do? It cannot produce content that is anchored in data that no one else has. And I think what's important to call out is this needs to be more than just survey research. This needs to be data that you, as an organization, have that literally no one else can get. The reality is just about anybody can replicate survey data. So it's like, what is the data that you have — that nobody else has — that provides incredible insight into what to do? I think that's what people are looking for. It's like, ‘what does good look like? And how do I get there?’ So, I would put this as a stack, because I think it's one of the only things left.”

Jones: “Yeah, I definitely believe that content based and original research data, this is a stack in 2024. And where I would like to see this go isn't just internal research. I would like for companies to think of ways they can open up their data to their own partners. I think it's very easy for us to get lost in the weeds. And if you go to partners, they can tell you other ways to cut the data to make it really interesting for end-buyers.

And so my hope isn't just that this is a stack, because I think that this is absolutely going to happen, but for it to hit its potential, we really think of how far we can stretch this, like opening up our data for original research. I'm very hopeful that we can do that, not just through leveraging AI and MLs, but by leveraging our own partners.”

Stack: ‘Growth at any cost’ is dead — 2024 is about balanced growth and profit.

Jones offers his CEO perspective, predicting that 2024 is when companies will position themselves for the next stage of growth, building and investing in value the right way rather than doing more with less.

Jones: “I think growth at all costs is absolutely dead — this is a stack for me. But I'll take it one step further, I think that what companies are going to be obsessed with is not just burn, but what does their cash flow look like? Because the companies that took the medicine in 2023 — cut costs, rolled up their sleeves, rebuilt their foundation, made really challenging decisions that impacted people and teams at their organization — those companies can position themselves for the next stage of growth. That next stage of growth doesn't mean actually bringing in any more capital. For folks working inside of technology, it's going to mean that our jobs evolve, it's not doing more with less, it's really an evolution of employment, an evolution of productivity.

I believe there's so much cash that's going to be turned on, especially in the second half of 2024. The metric that will matter most is going to be cash. I think that that will create a different version of balance. We often believe that balance equals slow and that isn't the case at all. Balance can actually mean having your foot pushed to the floor and going as fast as you possibly can in a sustainable way. And I think that that's the stage that we're moving into in the second part of 2024. There are real companies delivering real value across the board. The employees take great pride in their craft, there's teams that have come together and created incredibly innovative solutions.”

Stack: Multiple GTM motions in the works at a time

Calder and Jones both agree; most B2B companies are already doing this in 2024 by running inbound and outbound motions. Where they see this progressing further is for organizations to have complementary motions at play and attach partners to those multiple GTM motions.

Jones: “First and foremost, if you have multiple go-to-market motions, it just helps build a more resilient business. What I think is most exciting and where I want to see this go — and I don't know if it's ready in 2024 — is that I would love for the multiple go-to-market motions to actually complement each other. Direct and indirect should work hand-in-hand. In an optimal state, they should actually enhance each other, versus compete against each other.

Multiple go-to-market motions are really about just building a better customer journey and meeting the customers where they are and then pushing them over the line on value. Once you're able to deliver all of those things, that's how you optimize for the best revenue. I don't think that we're quite there yet, but I absolutely believe people understand that you need to have multiple go-to-market motions to build resiliency in your pipeline and ultimately, to grow revenue.”

Calder: “I agree. I think this has been happening for a long time. I don't remember a time where companies didn't have more than one motion at play. Just about every company has an inbound and outbound motion. To Bryn’s point, I think they could probably coordinate a little bit better. I think the trend that I'd be hopeful to see is more and more companies attaching partners to each motion. There's absolutely a world where your partners can help you bring in those target accounts a whole lot faster and much more efficiently. You’ve just got to do it, it's just got to be something that you attach to that motion. If you're predominantly a product-led motion, I think affiliates are completely under utilized in building your top of funnel PLG motion. So to me, that's the trend that I'd be hopeful to see, but I don't know if it's actually a trend right now.”

Read more: Critical points of trust within your ecosystem.

Snack: A new era of expertise and trust

As the industry becomes more discerning, will generative AI push the attention economy to a breaking point? Jones hopes so. A curation of thought leaders with the expertise, not the likes and follows, is what he’s hoping to see SaaS trend towards this year.

Jones: “My hope for all of us is that we move ourselves into an economy and into a world of substance. And I think that a lot of these tools that have now been put in place are going to enable people that have the substance to do that. I just don't know if the people that have the substance want to do it, because they're so focused on driving results day-to-day in their life.

Right now, I think a lot of the brands, the folks that are really focused on a lot of followers, they convert — or at least they say they convert — revenue. But what I actually think that they do is drive top of funnel eyeballs and then it'll be the substance that converts through the pipeline. And so, I hope we are in an era of expertise and trust. I think that there's a lot of skepticism now just built into the whole motion. And I don't want the followers and that stuff to disappear because I do believe it benefits further down the pipeline. I just don't know if the substance is going to overtake the reach conversation yet.”

Stack: Startup founders will select VCs more carefully

Jones doubles down on the prediction that alignment between VCs and founders is more important than ever, and that both will be searching for substance and incentives to drive satisfaction. PartnerStack’s CEO offers his hopeful outlook on what the future of work looks like.

Jones: “I believe that founders will select VCs more carefully. And I believe that VCs will select founders more carefully — I think it will be both. I think that a lot of VCs get a lot of flack and I think that a lot of founders get a lot of flack, whereas the reality is, in the innovative economy, what makes a good VC and a good founder? They're very different things, but there's a lot of similarities. The ones with substance, I believe will rise to the top because of the partnerships, because of the incentives, because of the support of the entire ecosystem.

I think in 2024, we're just going to find more satisfaction. And the reason why we're going to find satisfaction goes to incentives, alignment and focus. I think that we are going to be able to be focused on perfecting our crafts, not growing our teams. It's not about scale, it's about impact, it’s about incentives.

And the people that are able to get there, the people that can see the opportunity that's in front of us — and can see it as an opportunity — are going to be the ones that are just happier. They're going to be happier, because they drive more impact. They're going to be happier in their personal lives because they don't have the same level of stress or pressure. They're going to be able to get more creative. That to me is really exciting.

There's still pain to be worked through the system in order for us to ultimately get there. But you know, the truth is — and this is just anecdotally — when I speak with people inside PartnerStack and outside of PartnerStack, there's just a level of peace today. Because people are focused on controlling their own destiny, whether they [are] employees, investors, or founders, management teams, customers. When you can control your own destiny, there's deep satisfaction in the work that you can do day to day.”

.webp)